Structure of Organizations

Top 3 Most Prevalent Causal Inflation Narratives over Time

A Century of Inflation Narratives

Media: Hoover Daily Report | Northwestern Institute for Policy Research

with Mourad Heddaya, Chenhao Tan, Rob Voigt, and Qingcheng Zhang

(September 2025)

Analysis of inflation narratives in American newspapers since 1923, documenting their regional variation and predictive power for household inflation expectations.

Explanation of an AI Model’s Loan Approval Prediction

Explaining Models

Accepted EC’25

with Kai Hao Yang and Nathan Yoder

(May 2025)

A theory of explaining models that are too complicated to understand, with applications to social policy evaluation and explainable AI.

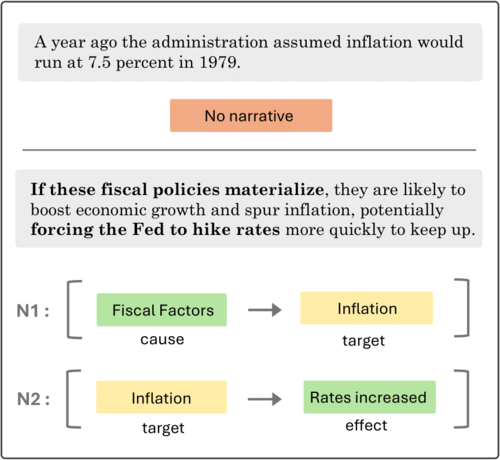

Example of Inflation News, but no Narrative (top) vs. Inflation Narratives (bottom)

Causal Micro-Narratives

Association for Computational Linguistics: Empirical Methods in Natural Language Processing 6th Workshop on Narrative Understanding Proceedings, 1: 67-84 (2024)

with Mourad Heddaya, Qingcheng Zhang, Chenhao Tan, and Rob Voigt

[Preprint]

Causal micro-narratives are sentence-level explanations of the cause(s) and/or effect(s) of a target subject. An approach to extract these narratives from real-world text using large language models (LLMs), with an application to inflation narratives.

An Extreme Point of a Monotone Function Interval

Monotone Function Intervals: Theory and Applications

American Economic Review, 114(8): 2239-2270 (2024)

Lead Article

EC’23 Version

Media: Election Law Blog | VSET | Yale Insights | Kudos

with Kai Hao Yang

Characterization of the extreme points of monotone function intervals. We apply this characterization to political economy, Bayesian persuasion, the psychology of judgment, and security design.

The Firm’s Boundary Overlaying a Production Network of Inputs

Corporate Culture as a Theory of the Firm

Economica, 91(364): 1391-1423 (2024)

NBER Working Paper #27353

Media: VoxEU | Harvard Law School Forum | Forbes

with Gary Gorton

Theory of the firm based on corporate culture. Firms exist because the shared values, customs, and norms of a corporate culture at times is more efficient at producing things than detailed contracts.

Cultural Weights

Social Progress and Corporate Culture

Industrial and Corporate Change, 32(3): 733-754 (2023)

NBER Working Paper #25484

Media: Yale Insights | Yale Daily News

with Gary Gorton

If society progresses in the treatment of minority groups, can corporate cultures do the same? A theory of how corporate cultures are determined and whether competition can push regressive ones out of the market.

Corporate Culture

Annual Review of Financial Economics, 14: 535-561 (2022)

NBER Working Paper #29322

Media: Harvard Law School Forum | MarketWatch

with Gary Gorton and Jillian Grennan

Critical review of the economics and finance literature on corporate culture.

Optimal Portfolio Policy with Two Levels of Bailout Money

Risk-taking under a Punishing Bailout

(R&R, Review of Asset Pricing Studies)

(September 2022)

A model of levered portfolio choice with a punitive bailout guarantee. Risk-taking actually declines with net worth, unless the fund's failure is imminent, in which case risk increases drastically.

Gerrymandered map of a circular city and adjacent suburban and rural areas

Gerrymandering and the Limits of Representative Democracy

with Kai Hao Yang

(subsumed paper)

How severely can unrestrained gerrymandering distort the composition of elected representatives? In the extreme, it can lead to a one-sided congress.

Stochastic Dominance Interval Characterizing the Distribution of Posterior Medians

Distributions of Posterior Quantiles and Economic Applications

with Kai Hao Yang

(subsumed paper)

Characterization of the distributions of posterior quantiles under a given prior. We apply this characterization to topics in political economy, Bayesian persuasion, industrial organization, econometrics, finance, and accounting.

Structure of Markets

Bank Branch Access across the U.S.

What Drives Disparities in Bank Branch Use? A Geospatial Analysis

Review of Finance, Forthcoming

Media: Yale Insights | Economic Mobility Project

with Jung Sakong

(May 2025)

Examines the drivers of low bank branch use in low-income and Black communities. Lower use in low-income areas stems from reduced demand, while in Black communities it's driven entirely by poor access.

Regions of Indeterminacy

Segmentation and Beliefs: A Theory of Self-Fulfilling Idiosyncratic Risk

Journal of Economic Theory, 224: 105954 (2025)

with Paymon Khorrami

[Preprint]

A theory of idiosyncratic risk due to capital market segmentation. Explains the common factor structure in idiosyncratic volatility and several puzzles in exchange rate dynamics.

Yardstick Price Caps Defining the Market Entry Rules

Regulating Oligopolistic Competition

Journal of Economic Theory, 212: 105709 (2023)

with Kai Hao Yang

[Preprint]

How do you best regulate an oligopoly when production costs are unknown? Solicit prices from firms, and based on those prices, charge them taxes or give them subsidies, and impose on each firm a “yardstick” price cap that depends on the posted prices of competing firms.

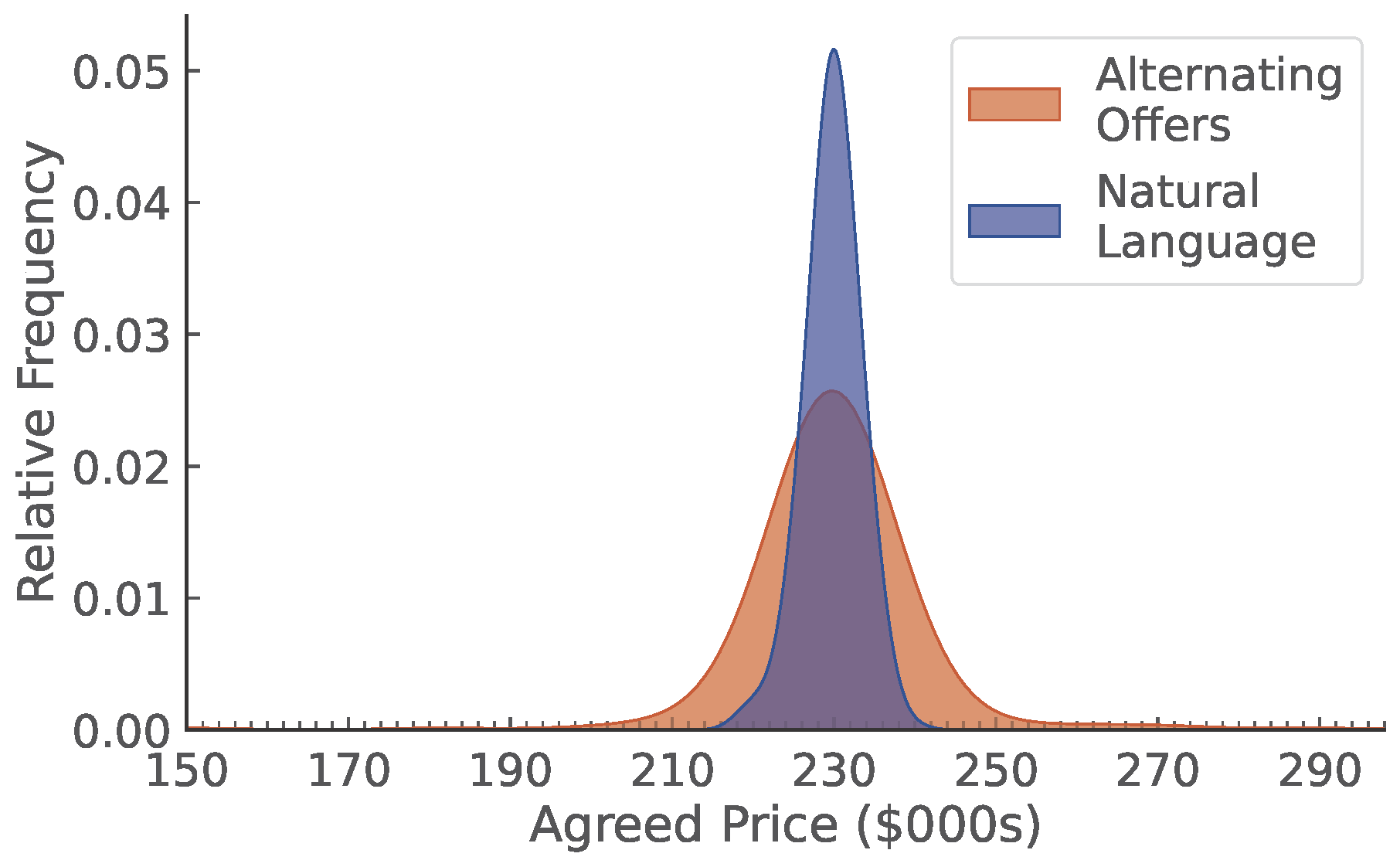

Distributions of Agreed Prices under Alternating Offers and Natural Language Bargaining

Language of Bargaining

Association for Computational Linguistics 61st Annual Proceedings, 1: 13161–13185 (2023)

with Mourad Heddaya, Solomon Dworkin, Chenhao Tan, and Rob Voigt

[Preprint]

An experimental study of how natural language shapes bilateral bargaining. When subjects can talk, fewer offers are exchanged, negotiations finish faster, the likelihood of agreement rises, and the variance of agreed prices drops.

Arbitrageur Capital and the Equilibrium Fire-sale Payoff of the Collateral Asset

Self-Fulfilling Asset Prices

Review of Asset Pricing Studies, 12(4): 886-917 (2022)

Anticipated market liquidity is an important concern for arbitrageurs considering entry into a market, a concern that can generate self-fulfilling asset prices.

Bank Loan Market Competition

Bank Net Worth and Frustrated Monetary Policy

Journal of Financial Economics, 138(3): 687-699 (2020)

A theory in which monetary transmission to bank loan rates depends on bank net worth. When banks are flush with equity, transmission is wide open; when banks have little equity, transmission closes.